Brokers Digest: Local Equities – Property, Fraser & Neave Holdings Bhd, Genetec Technology Bhd, T7 Global Bhd

- Home

- Brokers Digest: Local Equities – Property, Fraser & Neave Holdings Bhd, Genetec Technology Bhd, T7 Global Bhd

Brokers Digest: Local Equities – Property, Fraser & Neave Holdings Bhd, Genetec Technology Bhd, T7 Global Bhd

By Rosalynn Poh / The Edge Malaysia

19 Nov 2024, 02:30 pm

This article first appeared in Capital, The Edge Malaysia Weekly on November 11, 2024 – November 17, 2024

Property

Overweight

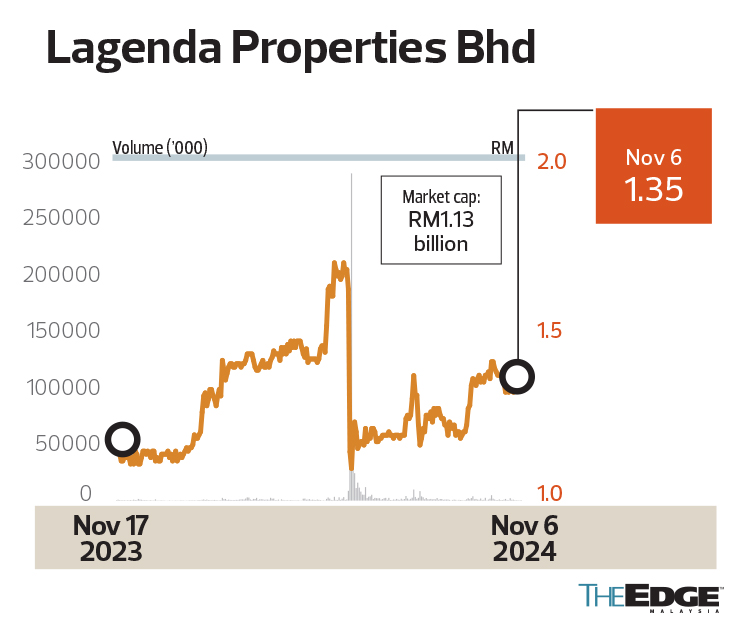

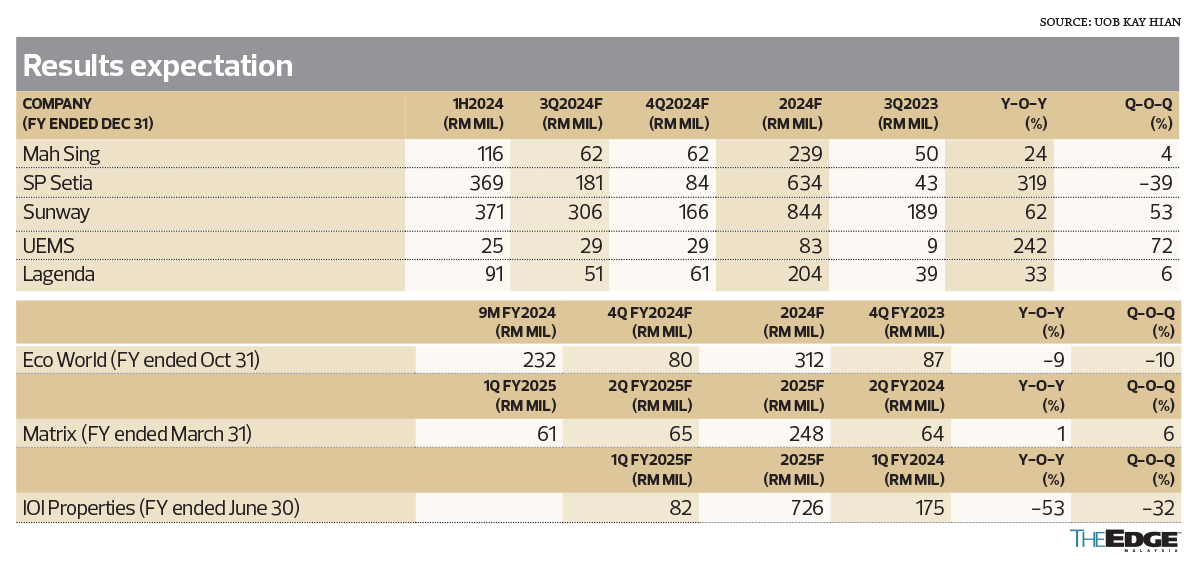

UOB KAY HIAN (NOV 6): Most developers under our coverage are expected to report stronger results for 3Q24, especially S P Setia Bhd (KL:SPSETIA) and UEM Sunrise Bhd (KL:UEMS), driven by contributions from land sales. Sales in 3Q24 are also anticipated to be strong, supported by an increase in launches during the quarter. For 2025, we expect sector revenue to maintain double-digit growth at 11%, driven by higher sales and progressive billings. Additionally, we forecast sector earnings to grow by 18%, outpacing revenue growth due to higher-margin land sales and industrial properties.

Our top picks include laggards such as Lagenda Properties Bhd (KL:LAGENDA) and IOI Properties Group Bhd (KL:IOIPG). We also like developers with data centre exposure such as Mah Sing Group Bhd (KL:MAHSING) and Eco World Development Group Bhd (KL:ECOWLD).

Land sales are expected to remain a substantial contributor to sector earnings in 2025, with developers under our coverage projected to generate a cumulative net gain of RM885 million (+28% y-o-y), primarily from data centre land sales. This represents 23% of the sector’s total net profit (+3 percentage points y-o-y).

In 2024, S P Setia leads the sector’s land sales contributions with a net gain of RM578 million. In 2025, S P Setia is expected to lead again with a projected net gain of RM350 million from industrial plot sales, mostly from its Setia Alaman Industrial Park. Eco World follows with an estimated contribution of RM188 million to net profit, while Sunway Bhd (KL:SUNWAY) and Mah Sing add around RM133 million and at least RM120 million respectively (all three gains arising from data centre land sales). We believe there could be additional land sales contributions to sector earnings in 2025, potentially from IOI Properties. Its management recently indicated that it may consider selling some land to data centre operators if the price is right, given current market opportunities.

We view Budget 2025 as neutral for the property sector, given the absence of significant initiatives. Notably, the expected revival of the Home Ownership Campaign and the introduction of the Madani Deposit Scheme were not mentioned in the budget.

While this budget does not mention the Johor Autonomous Rapid Transit (ART) or Light Rail Transit (LRT) projects, nor specific incentives for the Johor-Singapore Special Economic Zone, the government has stated that an announcement on these projects will be made by the end of the year.

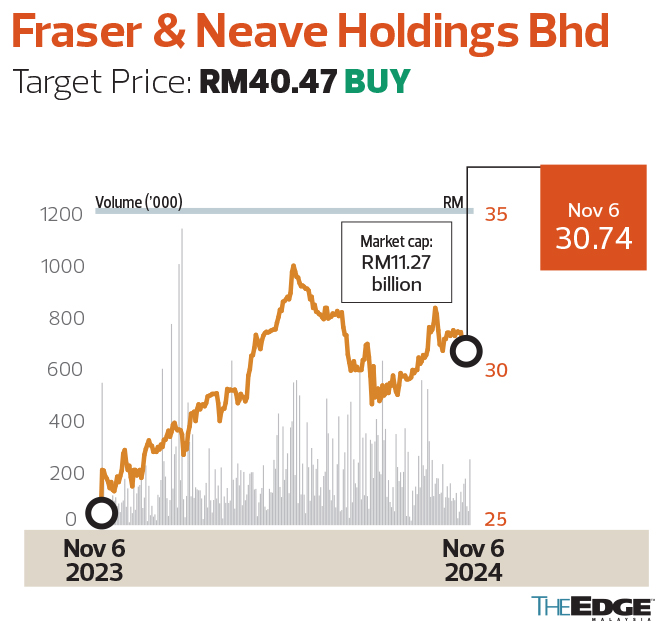

Fraser & Neave Holdings Bhd

Target Price: RM40.47 BUY

MIDF RESEARCH (Nov 6): Despite lower earnings in 4Q ended Sept 30, F&N (KL:F&N) concluded FY24 with a +15% y-o-y improvement in core earnings. This growth was driven by a 4.9% y-o-y increase in revenue, reaching RM5.25 billion, supported by steady gains in both food and beverage Malaysia (+3.5% y-o-y) and F&B Thailand (+6.7% y-o-y). In Malaysia, domestic demand remained strong while F&B Thailand saw a boost in domestic sales and higher exports to Cambodia following exclusive distribution rights for Bear Brand milk.

F&N’s commitment to growth is further emphasised by new production investments, including a manufacturing plant in Cambodia and additional production lines in Malaysia for carbonated beverages, drinking water, sterilised milk and chocolate.

We reiterate our “buy” recommendation for F&N and increase our target price from RM37, despite no adjustments to our earnings forecast. We remain optimistic about F&N’s prospects, supported by sustained demand for out-of-home beverages, a rebound in tourism to Thailand and Malaysia and shifting consumer preferences toward local brands. Looking ahead to 1QFY25, we anticipate revenue growth driven by consumer stockpiling for the holiday and festive season.

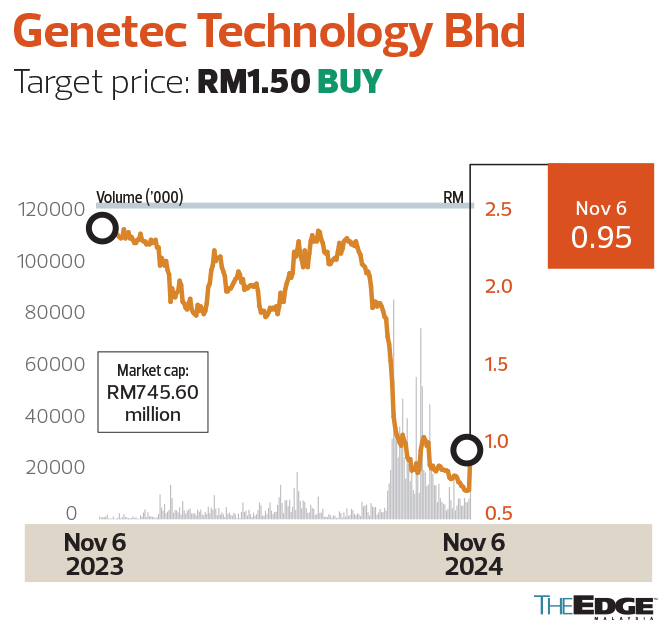

Genetec Technology Bhd

Target price: RM1.50 BUY

CIMB Securities (Nov 5): Genetec (KL:GENETEC) has announced plans to divest its 51% stake in CLT Engineering (CLT) to former executive director Tan Moon Teik for RM21.6 million in cash. Tan currently holds the remaining 49% stake in CLT. CLT specialises in parts fabrication and system assembly for back-end equipment used in the manufacturing of hard disk drive (HDD) lines and semiconductors for the electrical and electronics industry.

The proposed disposal will enable Genetec to realise the value of its investment in CLT, with the cash proceeds helping to meet funding needs for raw material purchases within the electric vehicle and energy storage segments. Genetec stands to book a gain of RM291,000 from the proposed disposal, excluding an estimated RM500,000 in transaction expenses. We believe the proposed disposal will be positive for the group and removes the potential earnings drag from CLT. The deal will require approvals from non-interested shareholders of Genetec and any relevant authorities.

Genetec’s stock has fallen by 71% YTD due to slower order replenishment amid cautious approaches from its customers. We maintain our “buy” rating on the stock with an unchanged target price.

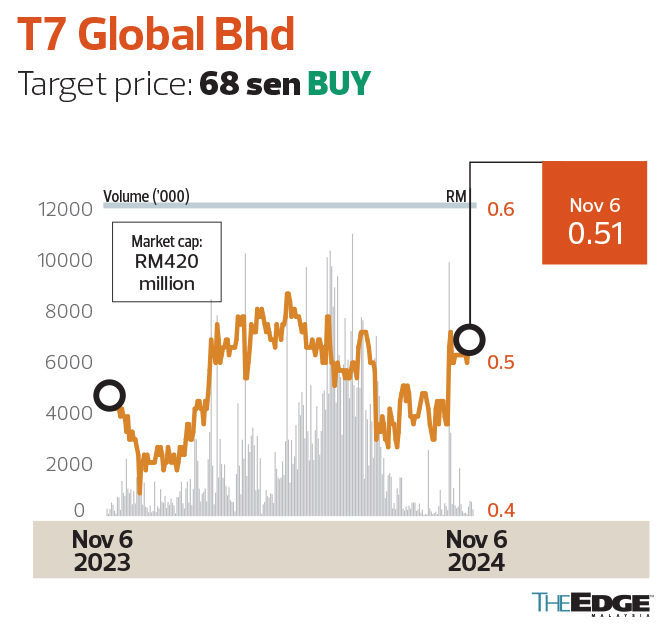

T7 Global Bhd

Target price: 68 sen BUY

Philip Capital (Nov 6): T7 Global (T7) [KL:T7GLOBAL] was awarded one of the maintenance, construction, modification (MCM), and hook-up commissioning (HUC) services contracts for Package B2 (Guntong) by ExxonMobil Exploration and Production Malaysia. The contract, effective Dec 1, 2024, has a five-year duration, with an extension option for an additional 3+2 years.

With overall MCM service rates increasing by approximately 20%, the net profit margin for this contract is expected to be higher than that of the previous MCM contract. Assuming a net profit margin of 9% (in line with management guidance), the estimated contract value of RM500 million is projected to generate RM9 million in profit after tax annually from 2025 to 2029, representing 18% of our existing 2025 earnings forecast.

With this contract win, T7’s total outstanding order book is estimated at RM3.1 billion. We expect more positive contract awards in the coming weeks, as only four of the 18 available HUC/MCM Pan Malaysia packages have been announced so far.

We make no changes to our earnings forecast, as this contract win falls within our order book replenishment assumption. We reiterate our “buy” rating and SOP-derived target price, which implies an 11 times forward 2025 EPS.